Don’t Tell Them How Good You Are. Show Them!

This article recently appeared in Opalesque New Managers (Issue 58, February 2017) – an online news publication focusing on the global emerging hedge fund manager.

Wouldn’t you be dubious?

When somebody tells you that they have a unique, innovative business model, doesn’t your skepticism kick in and prod you to think, “I’ll decide for myself just how unique and innovative it is after I see what it’s all about”?

And, when someone tells you how honest and trustworthy they are in their business dealings, don’t you usually sense that they “doth protest too much”?

That’s how investors typically react

Investors will react with considerable skepticism if you talk or write about your fund with a flood of self-serving sound bites without presenting sufficient supporting facts to substantiate them.

Facts speak louder than adjectives

Resist the temptation to overly rely on boastful adjectives and lofty nouns to extol your fund’s virtues. Rather than telling your audience how good you are, demonstrate it. Give them facts—the concrete things you do and the objective results you’ve achieved—and allow them to draw their own conclusions.

Remember, even boasts that are true can sound like clichés when many of your competitors are saying virtually the same thing.

Facts can differentiate you

To “demonstrate how good you are,” you’ll want to present facts that separate you from the pack. For example, introducing your audience to the advantages of an unknown, or little known, investment opportunity you’ve uncovered and the special method you’ve developed to exploit it. Or, revealing a particular catalyst that you have in your arsenal to enhance your strategy’s performance.

Facts can tell a story

Make sure you present your facts in a way that tells a convincing story. Random facts that seem to jump around won’t cut it. You need to connect the dots for investors and present things in an order that engages them and then keeps building their interest. (We’ll talk more about the importance of “the story” in a future article.)

Insightful thoughts (as well as persuasive facts) can also enhance your brand

Perhaps you have some specific insights related to your area of investing that can also help set you apart. If you have points-of-view that are fresh, perceptive and provocative, sharing them in your communications or presentations may lead investors to regard you as a thought leader. Thought leadership can be a powerful demonstration of brand superiority.

It’s OK to use promotional phrases and headlines

Although unsubstantiated sound bites should be held in check, that doesn’t mean you should avoid positive, compelling introductions to the facts and insights you present. In a pitch book, for instance, well-chosen headlines and sub-headlines can help move your narrative along and guide the reader. But make sure they’re appropriately descriptive of the factual text and charts they’re introducing.

Here are two examples

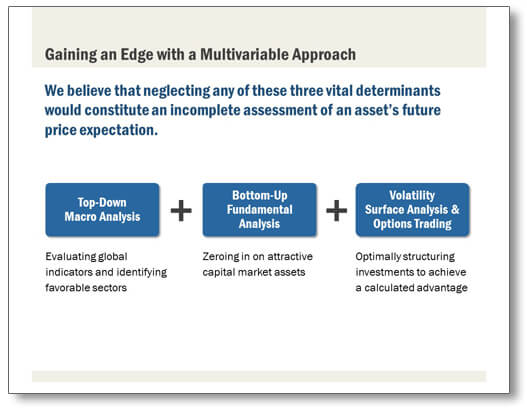

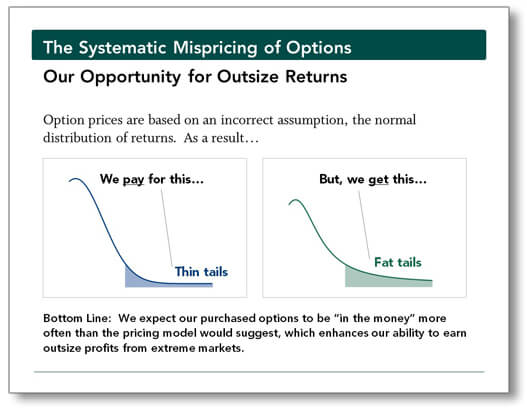

These two pages, excerpted from different pitch books, may help illustrate the above points.

Both of these pages have a strong headline from a marketing point of view—each conveys that the hedge fund possesses an important investment advantage. But each headline is solidly backed up by the substantive information it introduces—information that sheds light on the investment strategy and aptly supports the claim of investment advantage. Also, these two examples present the kind of managerial insights that can help establish a thought-leadership persona.

Keep these examples in mind as you seek to combine strong headlines with cogent facts and insights that demonstrate how good you are.